On January 1, 2018, the 115th Congress succeeded in pushing through one major piece of legislation before disbanding: the Tax Cut and Jobs Act (TCJA). The new law, which was co-sponsored by then-Speaker of the House Paul Ryan, adjusted tax rates and brackets, doubled the standard deduction, limited popular itemized deductions, and increased the lifetime exemption on estate tax to the highest level ever.

Which is to say: There’s a lot on the line, particularly for wealthy Americans, if the law is allowed to expire. Absent an act of Congress following what’s promising to be a divisive presidential election, TCJA will sunset at the end of 2025.

So, what will happen in 2026 if TCJA expires? And how can you prepare? Let’s dig in.

What happens if TCJA expires?

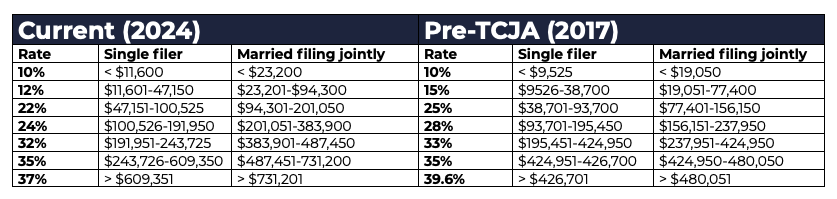

We’ll return to pre-2018 tax rates and brackets.

One thing that’s important to note: There have been several inflationary adjustments to tax brackets between 2018 and now. If tax code reverts to pre-TCJA tax brackets, those ranges will be updated for inflation. In other words, we’ll go back to the same brackets, but the dollar amounts will change.

Still, the marginal rate you pay may increase depending on how much you and/or your spouse earn.

The credits and deductions you qualify for may change.

The TCJA roughly doubled the standard deduction for both single filers and married couples filing jointly. As a result, the number of Americans who chose to itemize their taxes decreased significantly, since itemizing no longer offered a benefit. This impacted tax strategy for many Americans.

For instance, taking a charitable deduction requires you to itemize. Americans who regularly contribute to charity may no longer receive a tax benefit for their trouble if they don’t itemize for the year. Instead, charitably-minded families might engage in donation bunching or other strategies aimed at maximizing the tax benefit of their contribution while still helping the causes they care about. This type of planning may no longer be necessary when TCJA expires.

Other relevant deductions set to make a comeback?

· Currently, you can deduct any mortgage interest payments on up to $750,000 in mortgage debt. Prior to TCJA, this deduction included mortgages up to $1 million; if the law expires, folks with larger mortgages may be able to deduct their mortgage payments again.

· Right now, you can deduct any state and local taxes (SALT) you paid on real estate, personal property, and income or sales for the year… up to $10,000. That $10,000 limit came from TCJA, and it expires if the law does.

There are a few other smaller deductions, as well, but for higher-earners, these three—mortgage interest, SALT, and charitable contributions—rank highest.

One important note: TCJA changed how alimony payments are taxed. The payer can no longer deduct these payments; the recipient does not count alimony as income. This change is permanent and will not sunset even if TCJA expires.

Estate taxes will change

The TCJA significantly increased lifetime exemption for estate taxes, providing substantial relief to wealthy individuals. As of 2024, the federal estate tax threshold is $13.61 million for individuals and $27.22 million for married couples. Any assets above that threshold may be taxed at a rate of up to 40%.

TCJA did NOT change the estate tax rate, it simply raised (doubled) the exemption threshold. If TCJA expires, the lifetime exemption would revert back to $5.6 million for individuals or $11.2 million for married couples. It is possible that even if the law expires, these thresholds could be adjusted for inflation.

How to prepare for higher taxes post TCJA expiration

To be clear: Whether your taxes will or won’t increase in the case of TCJA expiring will depend on your personal circumstances—both now and in 2026. Some families may be able to take preventative steps now to help protect their assets and reduce their lifetime tax bill.

For our clients, the primary consideration with TCJA’s expiration ties to estate planning. Any individual that anticipates contributing more than $5.6 million—the lifetime exemption threshold we could revert to in 2026—may benefit from proactive planning. Consider an individual with a $4 million estate that she hopes to leave her heirs. If she plans to invest those funds while she’s alive, her assets could exceed $5.6 million in the future, triggering a federal estate tax for her heirs.

There are a number of trusts that individuals and families can use now to protect against any increase both the lifetime exemption and the overall estate tax rate. Trust law is complex, so I don’t want to go too far down the rabbit hole of which vehicles to consider, but suffice it to say a financial advisor, tax specialist and estate planning attorney may be able to save you and your beneficiaries a significant amount in potential taxes via proactive planning.

The biggest tip I can offer? Get started now. The closer we get to January 1, 2026, the more Americans will be aware of the looming expiration and it may be harder to book time with the experts who can best help you prepare your finances.