Most investors hate volatility; most advisors change the topic to risk management before they suggest you ignore the noise. So what causes the disconnect between regular investors and the pros? And do you need to pay attention to volatile markets? To answer those questions, we have to back up to discuss a few core concepts.

What is volatility?

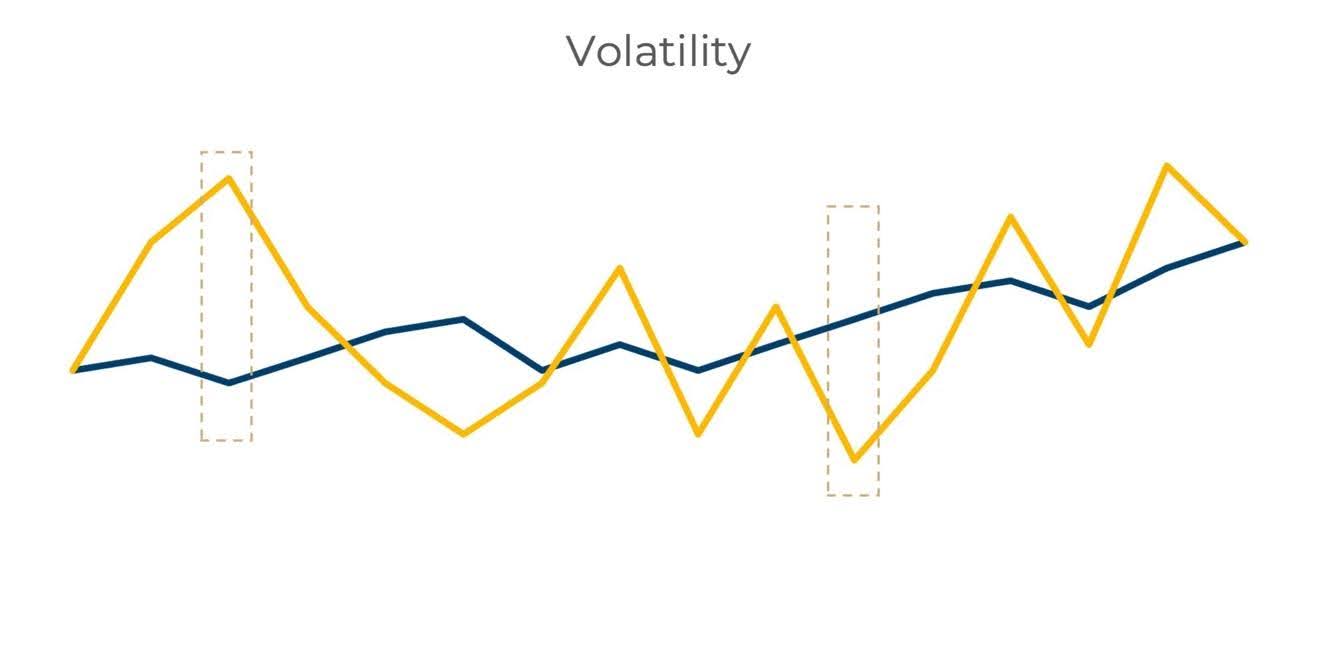

In real life, “volatile” refers to something unstable—and while that tends to have a negative connotation, it doesn’t have to. It’s the same for investments. Consider two stocks—yellow and blue.

The stocks start and end at the same price, but the yellow stock experiences far more ups and downs in between—it’s more volatile.

For professional traders, these price swings provide opportunities to make money. But, for most investors, they’re a distraction.

How does volatility work?

Certain assets tend to be more volatile than others. For instance, stocks are thought to be more volatile than bonds as a general rule because bonds are issued with a specific face value and coupon rate. While bond prices and yields can fluctuate on secondary markets, those movements may be more constrained.

Of course, asset classes aren’t uniform. Certain types of stocks, or even certain companies, may be more volatile than others. The slightest news can cause massive moves up or down in a biotech or pharmaceutical stock.

There are times when the market overall feels volatile—when a large number of stocks react to headlines and drive indexes, like the S&P 500, up or down. But as you may expect, not every stock reacts to headlines the same way, and certain companies and assets may weather volatility better.

For investors, the volatility of your holdings matters most if you have a short time horizon. If you expect to need your money soon, a big move up or down can derail your ability to meet your target within your time frame.

When do you need to care about volatility?

Going back to our yellow and blue stock example, the two start and end at the same price…for that time period. If you needed to sell that investment partway through the time frame, you could have ended up making significantly more or less on the yellow stock than the blue.

With longer time horizons, investments have more time to recover from potential declines. However, this theory applies more to markets overall than to specific investments—time does not make a historically volatile asset less volatile.

With longer time horizons, investments have more time to recover from potential declines. However, this theory applies more to markets overall than to specific investments—time does not make a historically volatile asset less volatile.

For retirees, this is particularly important. Selling assets during downturns can impact the size of your nest egg, especially if you aren’t contributing additional funds. It’s especially important for new or younger retirees to be mindful of market volatility, as downturns early in retirement can have a more dramatic impact, a phenomenon known as sequence risk.

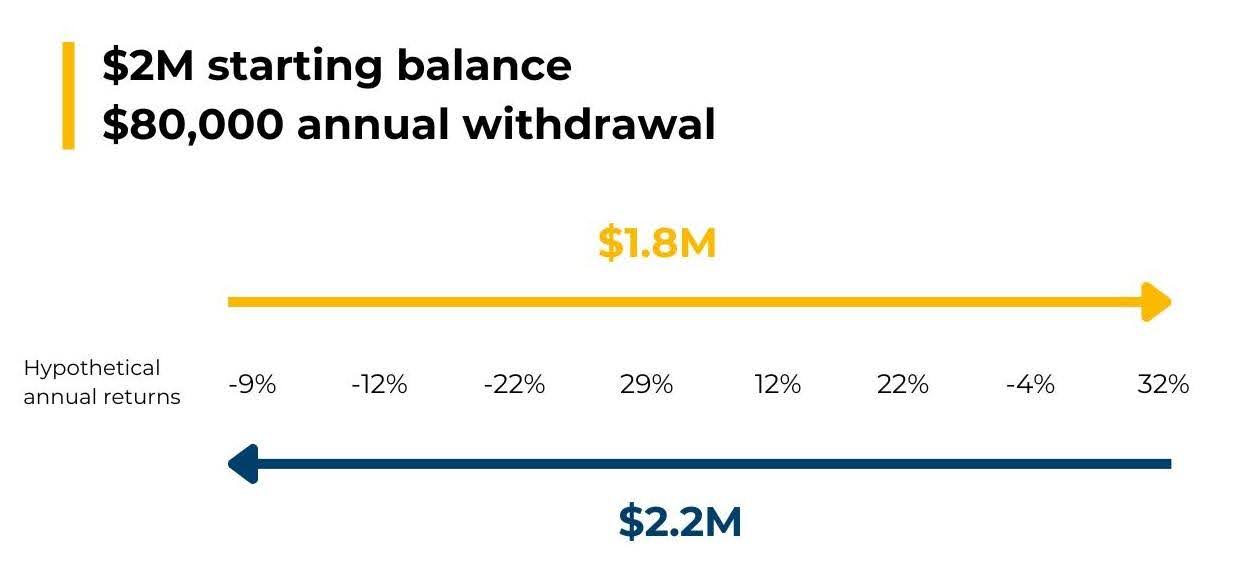

Consider eight years of hypothetical returns for a $2 million portfolio where the retiree withdraws $80,000 a year. If the big dips happen early on (moving left to right, as indicated by the yellow arrow), the retiree has $1.8 million at the end of eight years. If the dips happen later (moving right to left, as indicated by the blue arrow), the retiree’s nest egg grows to $2.2 million despite the withdrawals.

Of course, annual performance doesn’t necessarily correlate with overall market volatility. However, our goal is to illustrate that dramatic downturns that may be associated with volatile markets can have a significant impact on retirees, particularly early in retirement.

Anyone living on a fixed income or with a shorter time horizon may need to pay more attention to the volatility of their investments and the broader market. Your financial advisor should take this into account so you don’t have to. If you have questions about how volatile markets might impact your financial plan or future, contact our team to discuss.