As summer ends and September begins, attention is focused on the long-anticipated change in the Fed’s monetary policy, from holding rates steady to returning rates to lower levels.

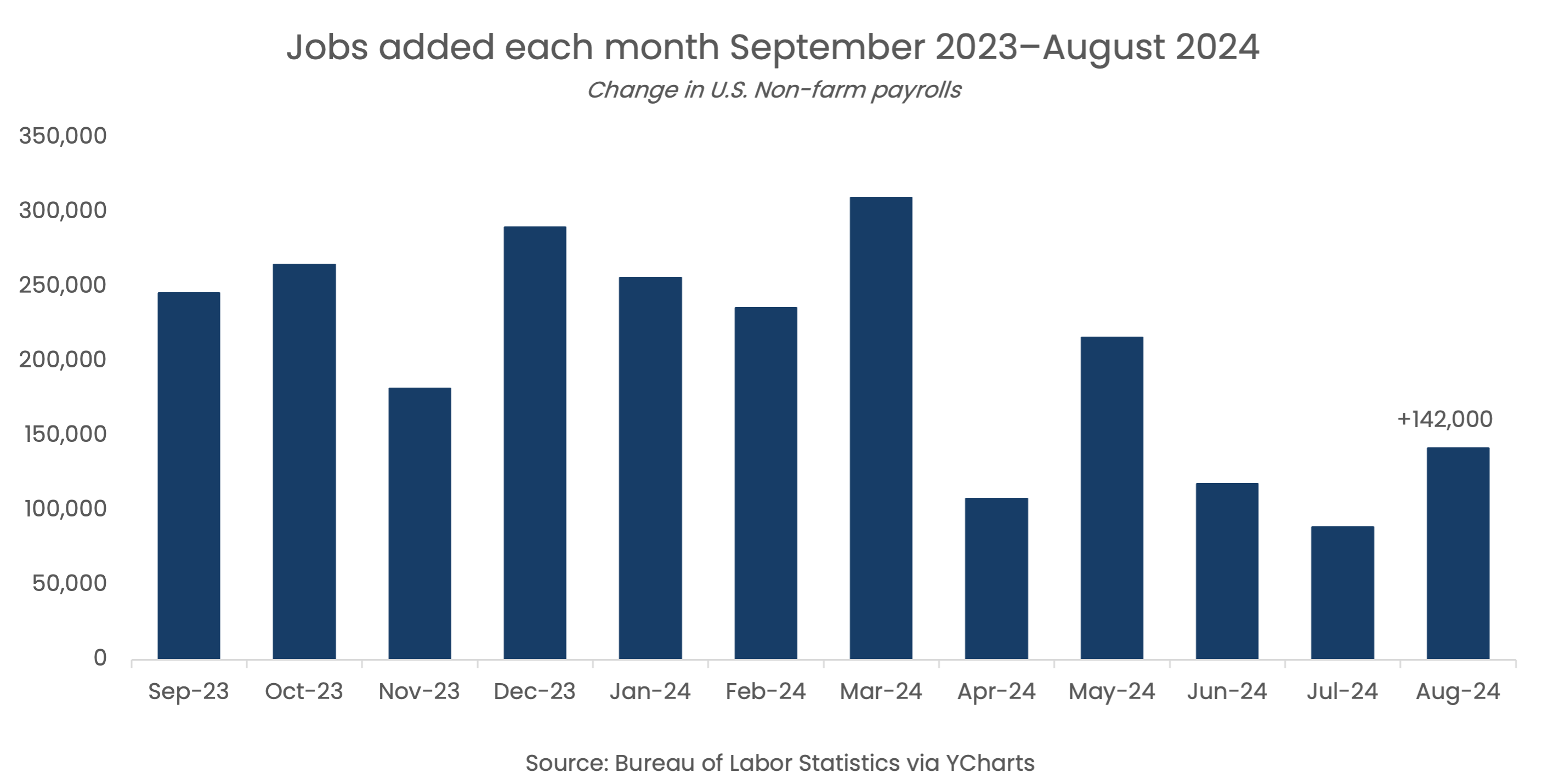

July and August non-farm payrolls indicate a slowing labor market, but other economic indicators are holding steady and show an economy that is still solid. While there is some conjecture that the Fed may kick off a new dovish regime with a 50-basis point rate cut, the general prudence and data-dependent stance of the Fed to date, along with the absence of any clear signs of trouble, would seem to indicate that a more modest 25-basis point cut may be more likely.

The market has seemed to return to a risk-on stance, despite some volatility.

Let’s get into the data:

- Non-farm payrolls increased by 141,000 jobs in August. The Labor Department’s Bureau of Labor Statistics report was below consensus expectations by 21,000 jobs.

- Inflation continues to trend in the right direction. PCE inflation, the Fed’s preferred measure, was steady at 2.5% year over year in July. CPI, the more common measure, rose 2.9%, the lowest yearly growth rate since March 2021.

- Consumer confidence rebounded. The Conference Board reported that its consumer confidence index reached 103.3 in August.

- GDP increased at a rate of 3.0% in the 2nd According to the Bureau of Economic Analysis, GDP in the “second estimate” increased markedly compared to the 1.4% increase in the first quarter.

What does the data add up to?

After holding steady on rates since July of 2023, when the FOMC meets later in September, the most pressing question will be how much rates will decrease in this initial round of cuts. But more importantly, observers of the Fed will be parsing Chairman Powell’s comments at the post-meeting presser to try to determine how quickly rates will come down in the rest of 2024, and in 2025.

It can take up to 12 months for interest rate cuts to be fully felt throughout the economy, so the pace of rate cuts matters a great deal. As of early September, Fed fund futures are implying an 88% belief that by December 2024, rates will have come down by a full basis point.

Does the relatively strong economy justify such a large cut, so soon? GDP of 3% for the second quarter of 2024 was more than double that of the first quarter, with the increase driven by consumer spending and business investment. Consumer spending was particularly notable, as the purchases were for durable goods, like cars, furniture, and recreational vehicles. These large purchases are often financed, which tells us personal balance sheets are in pretty good shape.

One soft point in the GDP report was the rise in income of only 1.3% in the second quarter, the same amount as the first quarter. Lower income growth can spell trouble for consumer spending down the line, despite the rise in consumer confidence we saw last month.

Chart of the month: The Fed’s focus turns to labor

Labor markets remain solid but are slowing. If this trend continues, the Fed may feel compelled to lower rates more quickly.

Equity markets in August

- The S&P 500 was up 2.28% for the month

- The Dow Jones Industrial Average rose 1.76%

- The S&P MidCap 400 was down 0.21% for the month

- The S&P SmallCap 600 fell 1.62%

Source: S&P Global. All performance as of August 31, 2024

Of the eleven GICS sectors, nine were up with Consumer Staples in the lead. The month started with a continuation of July’s volatility, but in the end, the market recovered and the closing value was just shy of the July closing high. Notable about the impressive recovery was that the Magnificent 7’s dominance was diminished over the month.

Bond markets in August

The 10-year U.S. Treasury ended the month at a yield of 3.91%, down from 4.04% the prior month. The 30-year U.S. Treasury ended August at 4.20%, down from 4.31%. The Bloomberg U.S. Aggregate Bond Index returned 1.44%. The Bloomberg Municipal Bond Index returned 0.79%.

The smart investor

We’re about to see a change in monetary policy for first time in over a year. With rates poised to go down, consumers and investors will have new options and new choices.

Rates are likely to stay at a higher level compared to recent years for some time to come, so there is still time to lock in higher rates on CDs. And credit card rates and other high-interest-rate consumer debt will also go down slowly, so continuing to pay down debt now will save money. But another thing to think about is the impact of a new economic cycle on your portfolio. Are you taking enough risk, or too much risk? Are your investments structured to make the most of lower interest rates? If you are planning on retiring in the next few years, will your income investments keep pace?

Combining personal goals, investments, and a view on the economy is at the core of what a financial advisor can bring to the table. We’re always here to help.