The Federal Reserve’s November meeting went as the market expected: no change in rates. What wasn’t expected was the October and early November rollercoaster of bond yields. And by rollercoaster, think Kingda Ka.

The ten-year U.S. Treasury yield was briefly above 5.00% during the month. The last time it hit that level was July 2007. Falling bond prices were most likely the result of investor belief that the Fed would keep rates higher for longer. A strong economy and sticky inflation data supported this belief. Expectations that the U.S. Treasury would continue to increase supply in longer-dated Treasury auctions also contributed.

And then, the U.S. Treasury announced it would slow the pace of increases, as the borrowing estimate from October – December was cut by $76 billion. This was followed by Powell’s announcement that rates would remain at the current level. This combined to drive yields back down at the beginning of November.

Let’s get into the data:

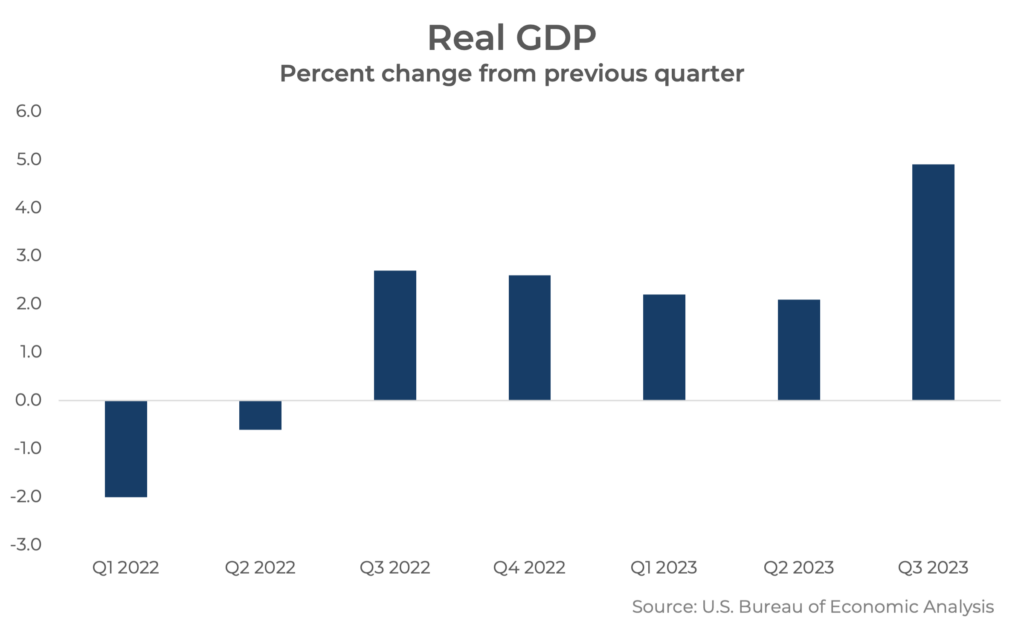

- GDP was a whopper. The Bureau of Economic Analysis reported 3Q GDP at 4.9%.

- The labor market cooled. The Bureau of Labor Statistics reported a non-farm payroll increase of 150,000 jobs in October.

- Consumer spending keeps ticking over. September personal consumption expenditures came in at 0.7%, almost double the August number.

- Labor force productivity surged again. The U.S. Department of Labor released the data on 3Q labor productivity: an increase of 4.7%.

What does the data add up to?

The Fed follows the data, the market follows the Fed, and the investor is confusedly bringing up the rear.

So, how to interpret a booming third quarter as measured by GDP, which would seem to indicate that inflation will remain higher? The increase was largely due to consumer spending on both goods and services and inventory investment by companies. PCE inflation (the Fed’s preferred measure of inflation) increased 2.9% after a 2.5% increase in the second quarter.

Yet the Fed held rates steady, and some interesting language was added to the official statement. Tighter financial and credit conditions for households and businesses.” An interpretation of this language is that the Fed feels that the rate increases already enacted are finally beginning to rein in the economy.

Powell was also clear that rate cuts are not being discussed at all. Powell’s messaging seemed geared to preventing complacency in expecting that monetary policy is at an inflection point. The Fed’s pause over the last two meetings should not be seen as a precedent that would make it difficult for rates to increase at the December meeting.

A cooling labor market is good news, but rising unemployment brings another risk. The risk of recession that hovered over the economy for most of 2023 has receded, but that may be temporary. The unemployment rate has increased from 3.4% in April to 3.9% in October. Rising unemployment can be a harbinger of recession.

The Sahm Rule identifies an elevated risk of recession. This rule-of-thumb compares the three-month average of the unemployment rate with the lowest average over the past year. Those two numbers are 3.83% and 3.5%, respectively. When the difference between the two exceeds .50, it can indicate that a recession is underway.

Chart of the month: GDP “advance” dstimate beats high expectations

The advance estimate for seasonally-adjusted, quarter-over-quarter GDP growth came in at 4.9%, beating expectations of 4.3% – the fastest pace in nearly two years.

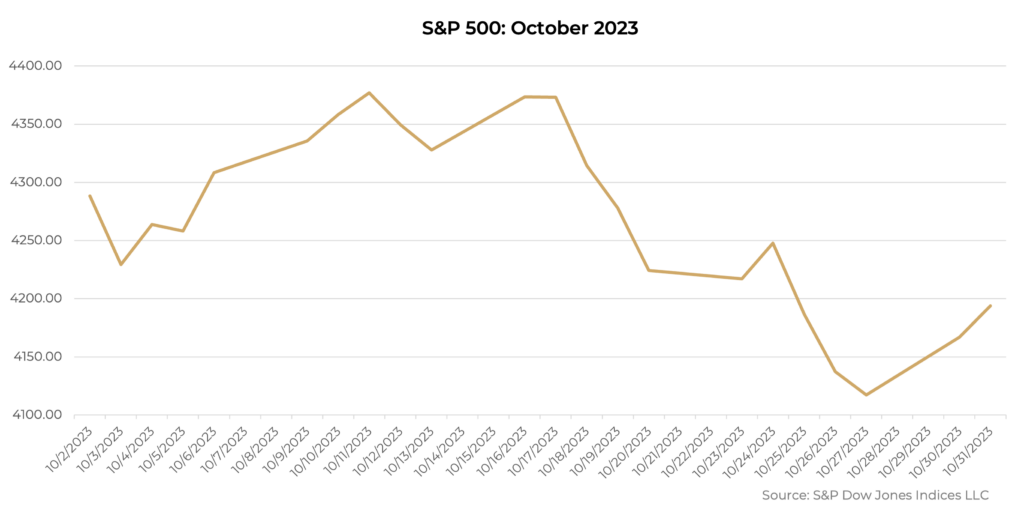

Equity markets in October

- The S&P 500 was down 2.20%

- The Dow Jones Industrial Average fell 1.36%

- The S&P MidCap 400 declined 5.42%%

- The S&P SmallCap 600 was down 5.83%

- Source: S&P Global. All performance as of October 31, 2023

October saw the third straight month of declines in the S&P 500, which almost finished the three-month period (August, September, October) in correction territory of more than a 10% decline. Positive performance in the last two days of October pushed the three-month number to -8.61%

All eleven sectors declined in October, with performance ranging from the barely-negative Utilities at -0.43% to worst-performing Industrials at -5.09%. Earnings season saw 77.5% of companies beating estimates, but future guidance was not as strong as hoped for.

Bond markets in October

The 10-year U.S. Treasury ended the month at a yield of 4.92%, up from 4.58% the prior month, after hitting 5.02% during the month. This marked the first time the 10-year Treasury has traded above 5% in 16 years. The 30-year U.S. Treasury ended October at 5.08%. The Bloomberg U.S. Aggregate Bond Index returned -1.58%, with a year-to-date return of -3.11%.

The smart investor

Equity markets saw strong positive returns for the first part of the year and then flipped the switch to several months of negatives. Even if the market ends up in positive territory, the performance of individual stocks in your account likely needs some attention.

Rebalancing your account to ensure that you are still within your preferred risk parameters is a good idea, and leaving yourself enough time to sell positions or add to other holdings over a period of time makes sense in choppy markets. Tax planning should be a part of this process as you harvest losses to reduce the impact of capital gains.

The holiday season comes quickly, and getting a plan in place now will allow you to head into the season of thankfulness with more peace of mind.