For those with excess discretionary income and a flexible workplace retirement plan, there may be a way to nearly triple 401(k) contributions and enjoy the future tax savings of a Roth account. It’s called a mega backdoor Roth, and not everyone qualifies—which is why this type of contribution isn’t discussed as frequently as other savings strategies.

For those with excess discretionary income and a flexible workplace retirement plan, there may be a way to nearly triple 401(k) contributions and enjoy the future tax savings of a Roth account. It’s called a mega backdoor Roth, and not everyone qualifies—which is why this type of contribution isn’t discussed as frequently as other savings strategies.

In this article, we’ll go over who qualifies for a mega backdoor Roth, how they work, and how they might fit into a holistic financial plan.

“Do I qualify for a mega backdoor Roth?”

It’s a common question since mega backdoor Roths aren’t available to everyone. To qualify, your employer must offer a 401(k), an after-tax contribution option, and in-service withdrawals or rollovers. You also need a Roth account—either a Roth 401(k) through your employer or a separate Roth IRA. Let’s look at each a little bit closer:

Traditional 401(k)

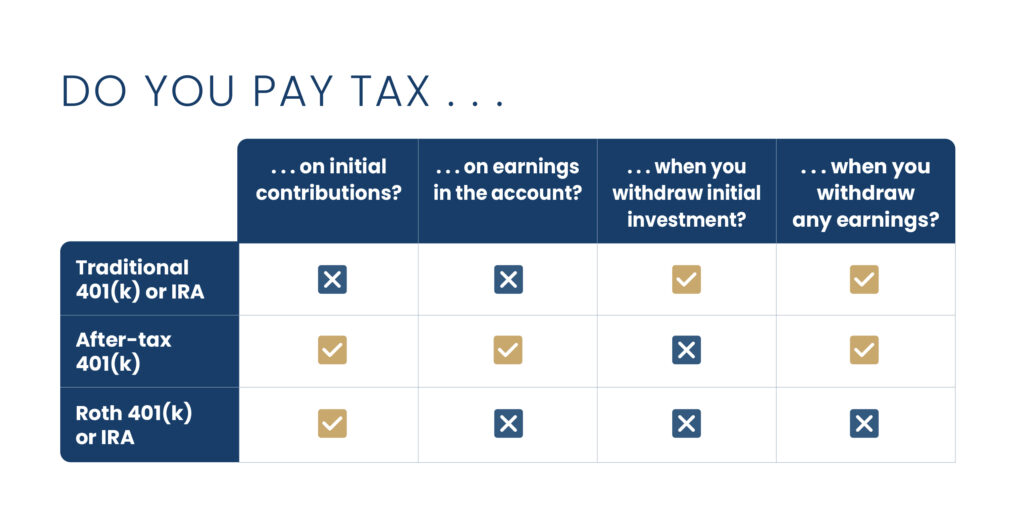

With a traditional 401(k) plan, you contribute pretax dollars, and the money grows tax-deferred, meaning you don’t pay taxes on any investment earnings or interest until you begin withdrawing from the account in retirement. Withdrawals on both your initial contributions and growth are then subject to ordinary income tax.

After-tax 401(k)

Some employers allow you to contribute to your 401(k) with after-tax dollars. With after-tax 401(k) contributions, you pay tax on any investment growth over time, but you won’t need to pay federal income tax on any withdrawals made in retirement. This tax advantage means the IRS limits annual after-tax contributions.

Roth 401(k) or Roth IRA

A Roth account is funded with after-tax dollars, and, like an after-tax 401(k), you don’t pay federal income tax on withdrawals in retirement. However, Roth accounts offer one major perk over after-tax 401(k) accounts: You won’t pay tax on investment earnings as your nest egg grows. While the IRS prohibits high earners from contributing directly to Roth IRAs, Roth 401(k)s don’t have the same income restrictions.

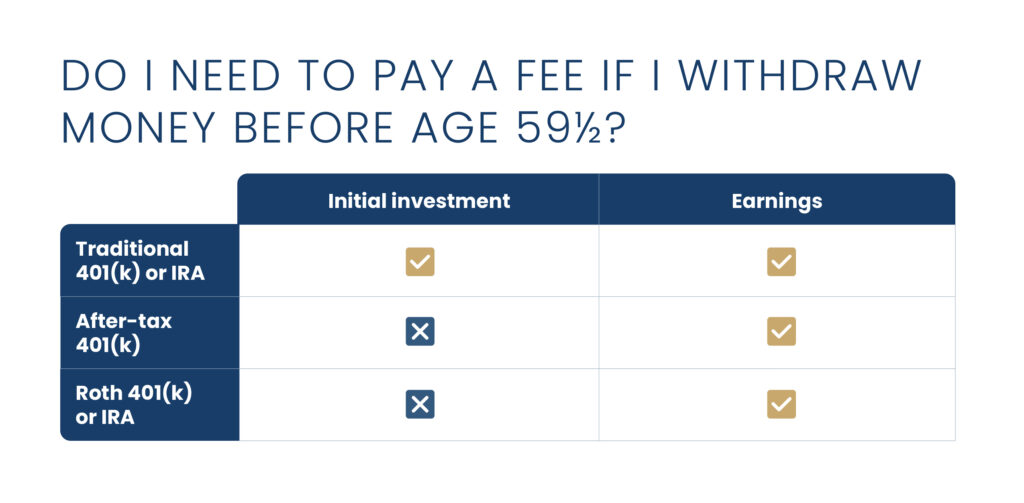

To help you differentiate between these common retirement savings vehicles, we put together a few comparison charts to illustrate how contributions are taxed and how the funds can be used.

The IRS limits how much you can contribute to tax-advantaged accounts each year, and each type of account comes with different limits and restrictions. Mega backdoor Roths help folks strategically maximize these various contribution limits.

In-service withdrawals or rollovers

Many plan sponsors restrict employees’ ability to withdraw or transfer money from an employer-sponsored retirement account while they’re still employed. If this is the case, you may not be able to do a mega backdoor Roth. However, if your employer offers in-service rollovers or withdrawals, you have the final component to make a mega backdoor Roth happen.

We’ve found that a growing number of publicly traded companies in the tech and health care space are including the ingredients for a mega backdoor Roth in their benefits packages. If you aren’t sure whether your employer offers these benefits, reach out to human resources.

How it works

If your employer-sponsored plan meets the criteria discussed above, you may be able to significantly boost your retirement savings by taking advantage of IRS contribution limits.

In 2023, the maximum amount you can contribute to your 401(k) in both pre- and after-tax dollars is $66,000. This includes both your contributions and any employer match.

Say you contribute the maximum $22,500 in pretax dollars to your 401(k), and your employer contributes an additional $6,000, for a total of $28,500. You would be eligible to contribute an additional $37,500 in after-tax dollars to the account—getting you to the $66,000 total.

While maximizing your contributions is certainly a benefit, the growth on your $37,500 after-tax contributions would be subject to tax. That’s where the mega backdoor Roth comes in. With a mega backdoor Roth, you use the in-service withdrawal feature to roll after-tax funds into a Roth account where it can grow tax-free.

In other words, your $37,500 after-tax contribution moves to a Roth account where it can grow tax-free.

Ideally, this rollover happens instantly. If not, you may need to pay taxes on any investment gains incurred in between the initial contribution and the rollover. Some retirement plan administrators handle the logistics for you, for exactly this reason.

For instance, some employees who want to contribute to a mega backdoor Roth can elect to automatically move their after-tax contributions to their Roth 401(k). If you aren’t sure, human resources and/or the administrator in charge of your employer-sponsored retirement plan may be able to help.

Sample Case Study—Client at a Big Tech Company

Here’s a look at how an employee at a big tech company might take full advantage of their mega backdoor Roth benefit in 2023:

- Contribute the full $22,500 to your 401(k) pretax if you’re younger than 50.

- If you’re older than 50, you can contribute even more thanks to catch up provisions.

- As a plan benefit , the employer contributes $11,250 to match.

- Since your pretax contributions total $33,750, you can contribute another $32,250 in after-tax dollars. (Remember, the total ceiling is $66,000 for 2023.)

- Tell the plan administrator you want to move your after-tax contributions into a Roth account and elect an instant rollover.

- The plan administrator immediately converts your after-tax contributions.

While mega backdoor Roths require upfront planning, there is no additional work required once everything is set up.

There’s more planning involved in mega backdoor Roth contributions than simple logistics. Employees who want to take advantage of this benefit must also consider how maxing out various retirement account contributions fits as part of a holistic financial plan.

At Quorum Private Wealth, we help clients think strategically about how to prioritize and time their retirement account contributions. For example, we might look at how to prioritize contributions that come out of your standard paycheck versus bonus pay. We may also evaluate after-tax contributions alongside your goals, emergency savings, and any outstanding debt.

If you have questions about whether you qualify for a mega backdoor Roth, or you know you have the option but aren’t sure whether you’re in a position to take advantage of it, schedule a time to chat.