For teens, summer jobs are a rite of passage. For parents, summer jobs are a fantastic opportunity to teach kids about hard work, budgeting, saving, taxes, and investing. Many kids will have an easier time focusing on financial concepts when it’s their money on the line. In this article, we’ll walk through the various lessons you can tee up using a summer job, tips for teaching those lessons, and action items to set them up for success.

1. Open checking and saving accounts

In most states, you must be 18 to open a solo bank account. Help your teen get started with banking by opening joint checking and savings accounts with them, with the intention of transferring full ownership to them in the future.

· Explain the difference between checking and savings accounts.

· Review account details and fine print with your teen.

Tip: This is where your teen will be depositing their paycheck, so they’re more likely to care about the balance requirements, interest rates, and fees involved. Be sure to discuss what happens if they overdraft. (Be sure to cover the gamut, from declined transaction fees to bank fees and overdraft protection.)

2. Create a budget

Many families don’t discuss budgeting details with their kids, so your teen may not know some of the “golden rules” of budgeting that we take for granted. Make sure your child understands the three major spending buckets: needs, wants, and savings. Since you likely have their needs taken care of, a summer job is a great opportunity to help them understand the importance of balancing real-time rewards with future rewards.

Tip: Help your teen understand “the value of a dollar.” While your child may know that a pair of Nike sneakers costs $100, that might not mean anything to them. If, however, they $100 means X hours of work, the value of those shoes might change.

3. Use Roth IRAs to introduce taxes and investing

Your teen probably knows that Uncle Sam is going to take a chunk of their income, but it can still be a surprise to see that first paycheck less withholding. The good news, though, is that dependents younger than 19 likely won’t have to file or pay income taxes unless they make more than the standard deduction for the year.

This lack of income tax means your teen has an opportunity for a triple-tax advantage that you don’t have. Knowing that they can ‘one up you’ may get your teen excited to learn about Roth IRAs. Once you have their attention, explain tax-advantaged accounts. Try saying the following:

The IRS incentivizes Americans to save for certain big events by offering tax advantages.

– With traditional retirement accounts, like a 401(k) or IRA, the IRS doesn’t tax the money you contribute. Once invested, it grows tax-free (no capital gains tax) in the account. You pay income tax on money you withdraw in retirement.

– With a 529 college savings account, you pay income taxes on the money you contribute, but it grows tax-free, and you don’t pay income tax on withdrawals if you spend them on qualified education expenses.

– With a Roth IRA, you pay income taxes on the money you contribute, it grows tax-free, and you don’t pay income tax on withdrawals once you reach 59½.

If your child is paying attention, they might notice the opportunity: If they don’t have to pay income taxes, they can contribute to a Roth IRA tax free. The money then grows tax free and withdrawals are tax free in retirement. It’s a triple-tax advantage.

Tip: Highlight that you must earn income to contribute money to a Roth IRA in a given year. If your teen knows their summer job is the key to this rare perk, they may value it all the more.

If the tax perks didn’t get your teen excited (and they may not), switch gears to talking about investing. One of the best ways to pique a child’s interest in investing is via the eighth wonder of the world: compound interest.

Here are a few numbers, images, and talking points to help grab their attention.

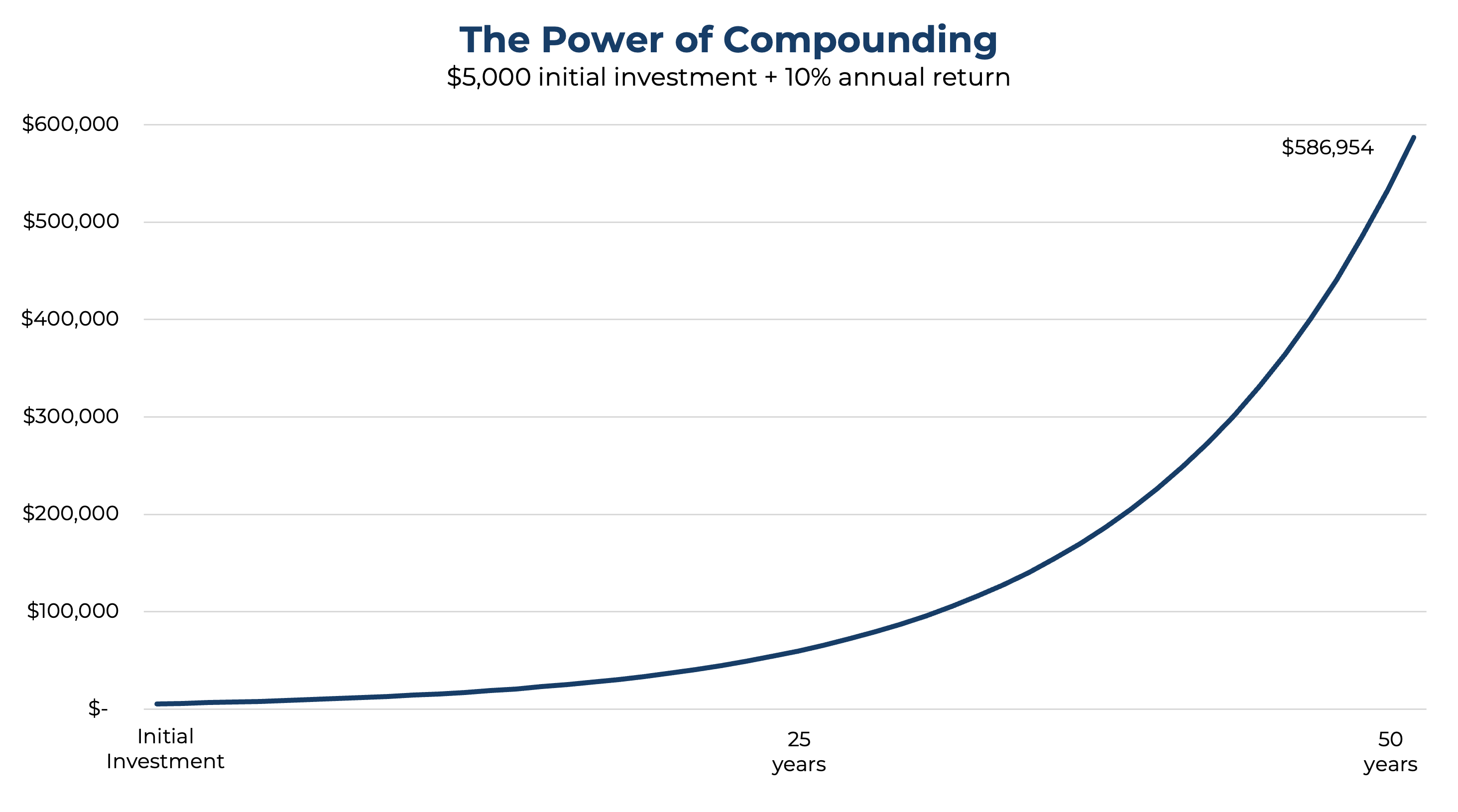

– If a 16-year-old invests $5,000 this summer, but never invests another dime, that money could grow to more than $580,000 by the time the teen is 66.

– This assumes the investment returned 10% a year.

– At a more modest 7% return, the money would still grow to 30x the original amount.

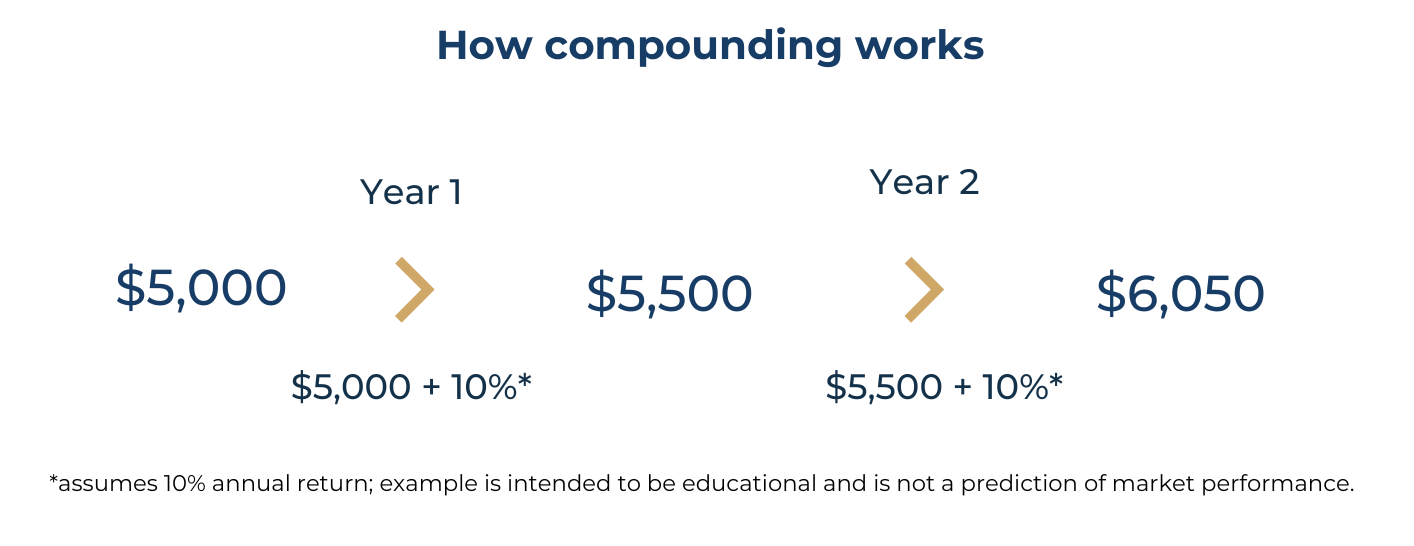

– Here’s how it works: The first $5,000 returns 10%, or $500, in year one. In year two, you have $5,500 invested. That returns 10%, which is now $550. In Year three, you have $6050 invested—now a 10% return is $605.

– In other words, the money you make each year is reinvested and starts making money of its own, known as compounding.

– Keep in mind: In the real world, the S&P 500 may average a 10% return but it doesn’t return 10% a year consistently.

– For instance, the S&P 500 went up 18% in 2020, 28% in 2021, fell 18% in 2022, and rose 26% in 2023), the historical average since the 1950s tends to be around 10%.

Hopefully the idea of growing $5,000 from a summer job into half a million has your teen excited about the prospect of investing some of their earnings. Along the way, they’re likely to gain real world experience with banking and taxes. If you’re interested in taking the steps to set up a Roth IRA with your child, Quorum may be able to help. Contact us about an appointment and we can sit down with you AND your teen to discuss their first job.