Contingent fee attorneys fight hard for their clients, who are often victims of horrible accidents or other tragedies.

But when it comes to paying taxes on those contingent fees, however, these attorneys become victims…of the progressive tax system.

The contingent fee tax dilemma

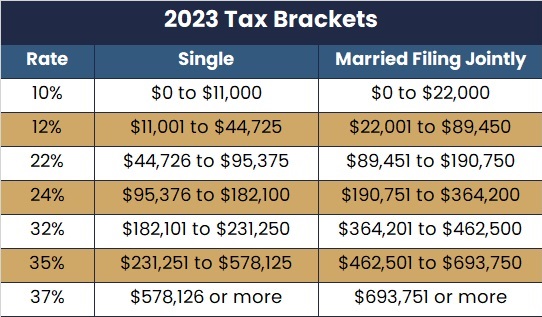

To recap: The percent tax you pay on earnings increases along with your income.

Attorneys often work on a case for years to achieve the settlement their fee depends on. But even when the work is spread over several years, the tax bill applies exclusively to the year in which the settlement (and fee) is paid.

Consider this example:

A married attorney filing jointly works diligently for five years to win a case and receives a contingent fee of $2.5 million. The federal tax on that is $847,814. If that fee were spread out over five years ($500,000 per year), that same attorney would pay just $612,523 in cumulative federal income tax on the fee.*

The takeaway is simple: Money earned in large lump sums triggers the application of the highest tax rates.

How contingent fee attorneys can lower their taxes

Contingent fee attorneys can remedy this problem with a structured fee or a non-qualified deferred compensation (NQDC) plan.

Structured fees piggyback on structured settlements, the same financial instruments many attorneys recommend to their plaintiff clients. Structured settlements are designed to meter the spending of monies that may be required over a lifetime.

While the guardrails of structured settlements can be very beneficial for plaintiffs, they can feel overly constricting to attorneys who simply want to lower their tax bill (and not guarantee lifetime income). Structured fees also require cooperation by defense counsel, and there may be limitations on how funds are invested.

NQDC plans, in contrast, offer the same tax advantages as structured fees (namely, avoiding “constructive receipt” doctrine that triggers tax liability) while providing significantly more flexibility and control over the funds.

For this reason, we often recommend NQDC plans for our contingent fee attorney clients.

How do NQDC plans work?

In Richard A. Childs, et al vs. Commissioner of Internal Revenue 103 T.C. No. 36 Docket No. 15639-92, the U.S. Court of Appeals for the 11th Circuit affirmed that attorneys who defer fees are not required to include them in taxable income until the fees are distributed.

This ruling gives contingent fee attorneys a powerful opportunity to manage and minimize their tax liability.

To use an NQCD, you must make a deferral election before you earn the fee. As part of the election process, you’ll specify the case and the amount you wish to defer. This can be a dollar amount, a percentage, or a combination thereof.

Upon settlement, the fee is paid to an independent financial intermediary who assumes the liability of paying benefits to the attorney per the deferral agreement.

Besides the obvious benefit of tax deferral, the NQDC structure offers two distinct advantages:

- NQDC plans offer a much broader array of investment choices than a structured fee, and the funds can be managed by a financial advisor.

- You aren’t required to make withdrawals on a specific schedule. Unlike a structured fee, you can schedule withdrawals whenever you wish, so long as you request the withdrawal a year in advance and don’t withdraw more than 5% of deferred funds per quarter.

As financial advisors at Quorum Private Wealth, we find these two features very compelling. Investment flexibility means that we can pay attention to tax location. We can also schedule withdrawals to coincide with gaps in retirement income or years we anticipate dramatically less income, which may reduce your tax bill even further.

Of course, there is a cost to set up a NQDC plan—typically 1% of the account balance per year. This fee is in addition to any fees charged by financial advisors, custodians, or asset managers. However, we believe the tax alpha (or tax savings potential) offered by these plans justifies the fees.

If you would like to know more about NQDC plans and how they might benefit you, please reach out to us at [email protected], or call 925-488-4001.

*Calculation assumes no additional income.

The subject matter in this communication is educational only and provided with the understanding that neither Sanctuary Wealth or Quorum Private Wealth are rendering legal, accounting, investment, or tax advice. You should consult with appropriate counsel, financial professionals, or other advisors on all matters pertaining to legal, tax, investment, or accounting obligations and requirements.