As goes January, so goes the year.

That old stock market canard has a double-edged meaning this year, as the stock market as measured by the S&P came in strongly positive. But the path to getting there included dashed expectations for lower rates in March and a slew of data that would seem to indicate a booming economy but with some cracks beginning to show.

The strength of the data, with solid GDP growth and falling inflation, was enough to have some economists declaring that either the “soft landing” for the economy had already occurred and the plane was safely on the ground, or it had refueled in mid-air and was gliding along nicely.

Whatever the metaphor, economic rules got broken in 2023, as the consumer held steady, unemployment stayed historically low, wages grew and somehow – inflation fell.

Fed Chairman Powell came under ferocious criticism for how long he waited to raise rates as the economy recovered from the pandemic, and for his insistence that inflation would be “transitory.” But once he got going, the speed and size of rate cuts were breathtaking. It looks now like the strength of the economic recovery allowed for a massive tightening without tipping over into recession. Is Powell a monetary policy magician? Or did he just get lucky?

That remains to be seen. Consumers are the backbone of the economy, and some recent data shows that the impact of inflation may be starting to hit consumers on the balance sheet.

Let’s get into the data:

- Labor markets hit the turbo button in January. The Bureau of Labor Statistics reported that the economy added 353,000 jobs in January, the highest amount in a year. December 2023 was revised upward by 117,000.

- GDP was sharply higher than expectations. GDP for the fourth quarter was 3.3% annualized, against forecasts of 2%.

- Wages may be beating inflation. The Bureau of Labor Statistics Real Earnings Summary showed an increase of 0.6% YoY in January. Over the 12-month period, wages are up 4.5%.

What does the data add up to?

The resoundingly positive data across GDP, consumer spending, wages, unemployment, and job creation we’ve seen since the beginning of the year is telling a story of an economy that has avoided recession, despite steep rate increases and high (if dropping) inflation.

How has this been possible? Labor productivity expanded in all four quarters of 2023, and for the last three quarters, it expanded by more than 3%. Workers producing more is keeping costs lower and helping the Fed in the fight against inflation.

But with supply chains normalizing, will the boom in labor productivity continue? For some observers, the impact of AI on the economy is the next promised land and will keep productivity high. Chairman Powell does not seem to share this view, at least in the short run.

So where does that leave rate cuts? The next FOMC meeting is late April/early May. There is one piece of data that the Fed may be looking at closely as it makes the decision. A recent report from the NY Federal Reserve shows delinquency rates on credit cards and auto loans are increasing, as consumers feel the pressure of higher rates.

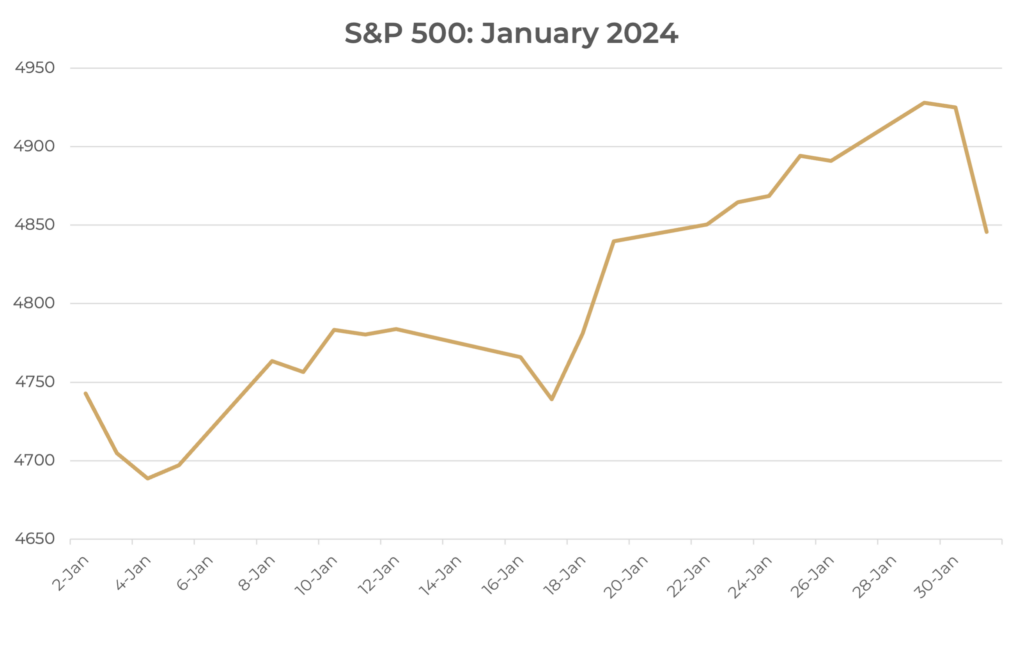

Equity markets in January

- The S&P 500 was up 1.59%

- The Dow Jones Industrial Average rose 1.22%

- The S&P MidCap 400 fell 1.77%

- The S&P SmallCap 600 was down 4.03%

Source: S&P Global. All performance as of January 31, 2023

Equity markets as measured by the S&P 500 posted six new closing highs during the month, after breaking through 4,800. Five of the eleven sectors gained, with Communication Services in the lead, up 4.84% for the month. Real Estate was the laggard, down 4.79%. The Magnificent 7 accounted for 45% of January return as they continued to gain, despite being expected to decline. Earnings have been stronger than expected, with almost half of companies reporting.

Bond markets

The 10-year U.S. Treasury ended the month at a yield of 3.93%, up from 3.88% the prior month. The 30-year U.S. Treasury ended December at 4.17%, up from 4.04%. The Bloomberg U.S. Aggregate Bond Index returned -0.27%.

The smart investor

The year is underway, tax season is in full swing, and high interest rates are holding steady for now. But we are definitely in for a regime change this year as rates head back down. Are you ready?

- If mortgage rates fall, will you reactivate a stalled home purchase? How about selling your home to downsize (or upsize) in retirement?

- If you moved investments to take advantage of high rates, do you need to revisit?

- Consumer interest rates won’t fall as quickly as they rose – credit card rates will stay high. Do you have a plan to pay down debt?

- Even though we are slowly gaining clarity on the economy, pockets of volatility will remain until there is a definite direction change on rates. Is your portfolio diversified?

Keeping your finances tracking to your goals sounds like a lot – but it’s really just a series of steps. If you have questions, we’re always here to help.