The transition to a new administration is underway with announcements of cabinet position nominees. The pro-business lean of the incoming government is not a surprise, and the emphasis is likely to be on deregulation and tax cuts. Several of the provisions of the Tax Cuts and Jobs Act of 2017 were set to expire in 2025, and those may get a reprieve.

In the near term, the focus is on the path of interest rates, and whether the Federal Reserve will move more quickly, or continue to stick to its data-dependent, cautious positioning. One hurdle seems to be cleared, however: Chairman Powell looks likely to remain in his post, at least for this point in the cycle.

Let’s get into the data:

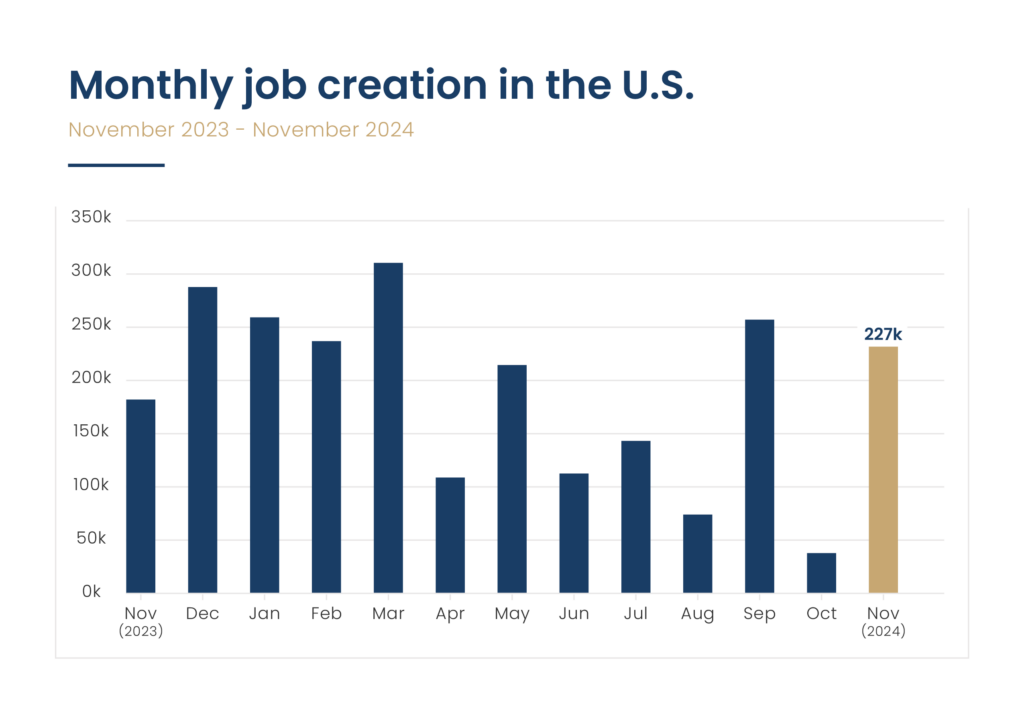

- Non-farm payrolls increased by 227,000 jobs in November. The Labor Department’s Bureau of Labor Statistics report was above the Dow Jones estimate of 214,000 jobs. In addition, the October number was revised upward by 36,000. The unemployment rate bumped up to 4.2%.

- Inflation as measured by CPI decreased further. CPI rose 2.6% for the 12 months ended in October, reversing the downward trend towards 2%.

- GDP rose at a 2.8% annualized rate in the 3rd quarter. The second estimate of GDP was in line with the late October estimate, but was below economists’ estimates of 3.1%. Consumer spending and government outlays fueled the strong GDP.

- The University of Michigan index of consumer expectations hit 74. The first read since the election showed overall sentiment at the highest level since April.

- Mortgage rates continued to drop. The first week of December saw the lowest rates since October, at 6.69%

What does the data add up to?

The robust labor number and continued strength in GDP could be seen as a reason for the Federal Reserve to pause on lowering rates, but the bump up in the unemployment rate will likely provide enough of an opening for the anticipated final 2024 rate cut of an additional 25 basis points.

The uptick in CPI last month could be an indication of stalling progress on inflation, but recent remarks from one of the Fed Governors, Christopher Waller, indicated that the FOMC is looking at forecasts that show inflation continuing on a downward path over the medium term. The Fed isn’t looking just at the 2% number. It is working to remove some of the restrictive monetary policy put in place when inflation was much higher. The drop in inflation from 9% to just above 2% is reason enough to remove restrictive policy and work towards a more neutral rate.

One of the biggest remaining hurdles for many investors is the state of the housing market. Low supply and skyrocketing prices locked out many would-be home buyers during the pandemic and after, and rapidly escalating mortgage rates have added to the problem. 2025 may see some relief.

Median home prices hit $437,000 in October, up from $426,800 in September, according to the most recent U.S. Census Bureau. However, home price growth is expected to normalize in 2025, according to Redfin. Over the second half of 2024, price growth settled into a 4% annual pace, similar to pre-pandemic levels. This is the projected level for 2025, according to Redfin.

Mortgage rates have trended down recently, which is good news for sellers and buyers. While the overall expectation is for mortgage rates to continue to fall, the path downward is likely to be bumpy, and the terminal rate for 2025 may not be as low as potential buyers are hoping. The consensus expectation is for rates to reach a low of 6.2% by the end of 2025.

Chart of the month: Job creation comes back

Source: U.S. Bureau of Labor Statistics via FRED

Data as of Dec. 6, 2024

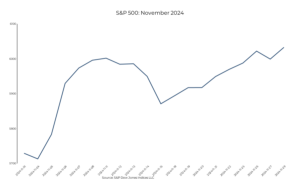

Equity markets in November

- The S&P 500 was up 5.73% for the month

- The Dow Jones Industrial Average rose 7.54%

- The S&P MidCap 400 increased 8.66% for the month

- The S&P SmallCap 600 returned 10.77%

Source: S&P Global. All performance as of November 30, 2024

All eleven GICS sectors gained, with Consumer Discretionary out front with a gain of 13.24 for November. The S&P 500 posted gains on 15 out of 20 trading days, and 385 issues were up for the month. The market hit six new closing highs for the month and closed above 6,000 for the first time.

Bond markets in October

The 10-year U.S. Treasury ended the month at a yield of 4.18%, down from 4.29% the prior month. The 30-year U.S. Treasury ended November at 4.36%, down from 4.48%. The Bloomberg U.S. Aggregate Bond Index returned 0.84%. The Bloomberg Municipal Bond Index returned 1.73%.

The smart investor

The 2025 level of the estate tax exemption increased to $13.99 million, from $13.6 million in 2024. This level was set to expire after 2025 by the 2027 Tax Cuts and Jobs Act, but it’s likely to stay around for longer with the change in regime. This can be a positive for estate planning, and if your plan was geared around a possible much lower exemption level, you may want to revisit your planning strategies.

There will likely be other changes, and we may see delays to other provisions or regulations that went into effect over the last four years.

Checking in on your plan, no matter what stage you are at in your financial life journey, can help you reach your goals.

Combining personal goals, investments, and a view on the economy is at the core of what a financial advisor can bring to the table. We’re always here to help.