Long before inflation hit the entire economy, it hit college prices. For decades, the cost of higher education has increased faster than prices overall, making it critical for parents to plan ahead if they want to help pay for their child’s education.

In that time, 529 college savings plans emerged as the best tool available to help parents save. That’s partly because lawmakers have expanded how these plans can be used. Created in 1996, 529s are tax-advantaged investment accounts intended to help families fund education. Let’s get into why you might want to open a 529, how they work, and how they fit into an overall financial plan.

Why a 529

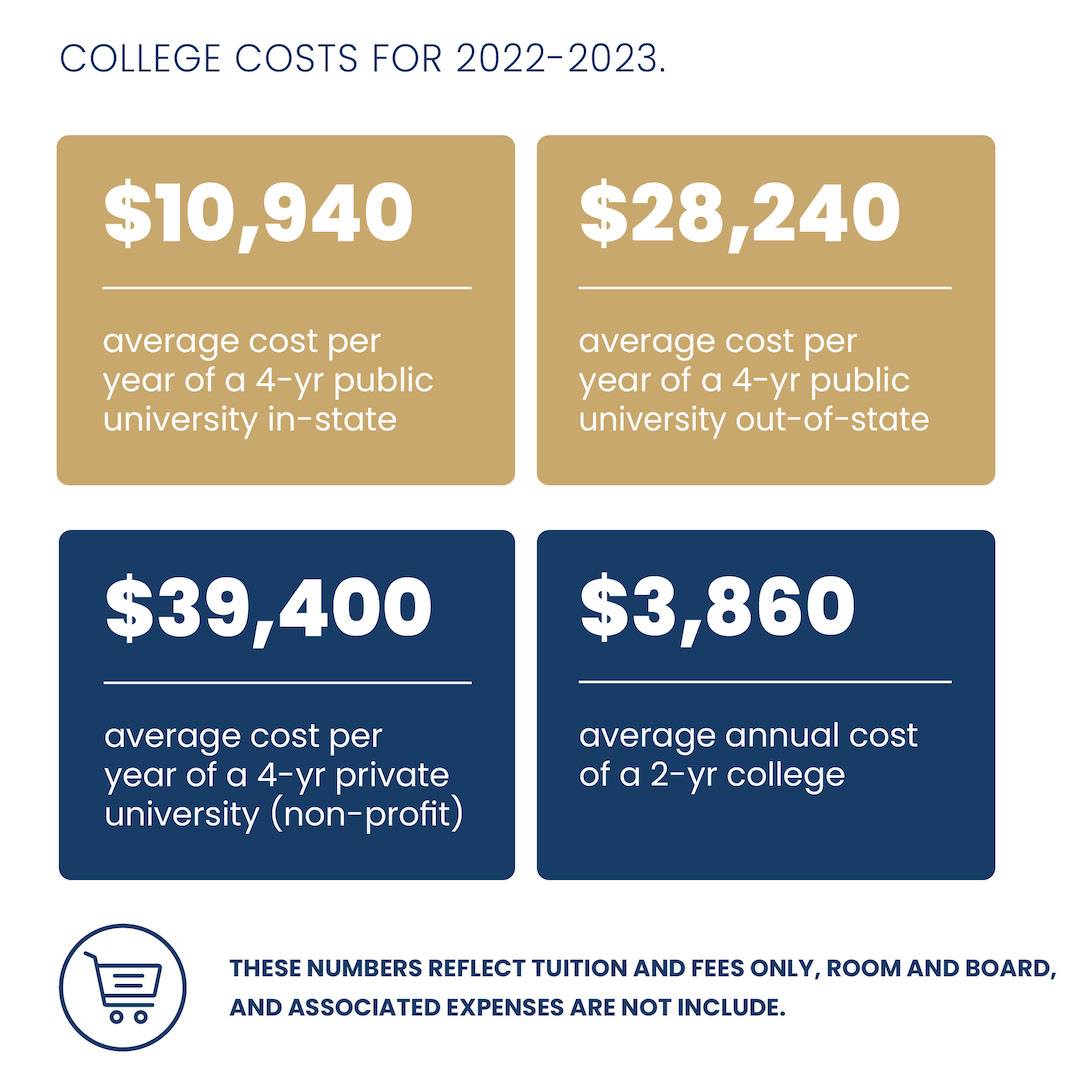

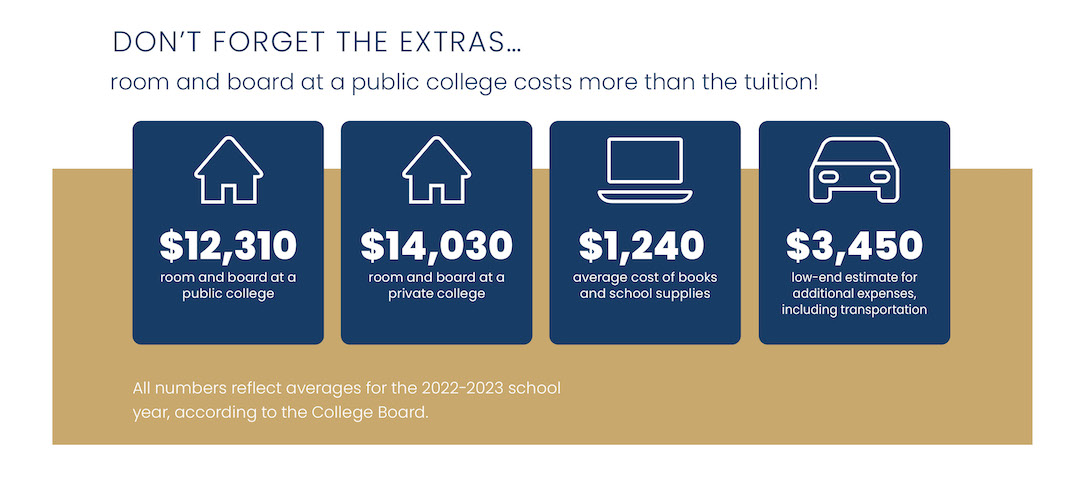

College is expensive. For the 2022 school year, a four-year, in-state public college cost nearly $11,000 per year on average. That number jumps to more than $28,000 if you attend a public university out of state or nearly $40,000 for a private school. And that’s just tuition. Room and board tops $12,000 per year.

(Note: For the most up-to-date information, the College Board releases regular reports on trends in college pricing.)

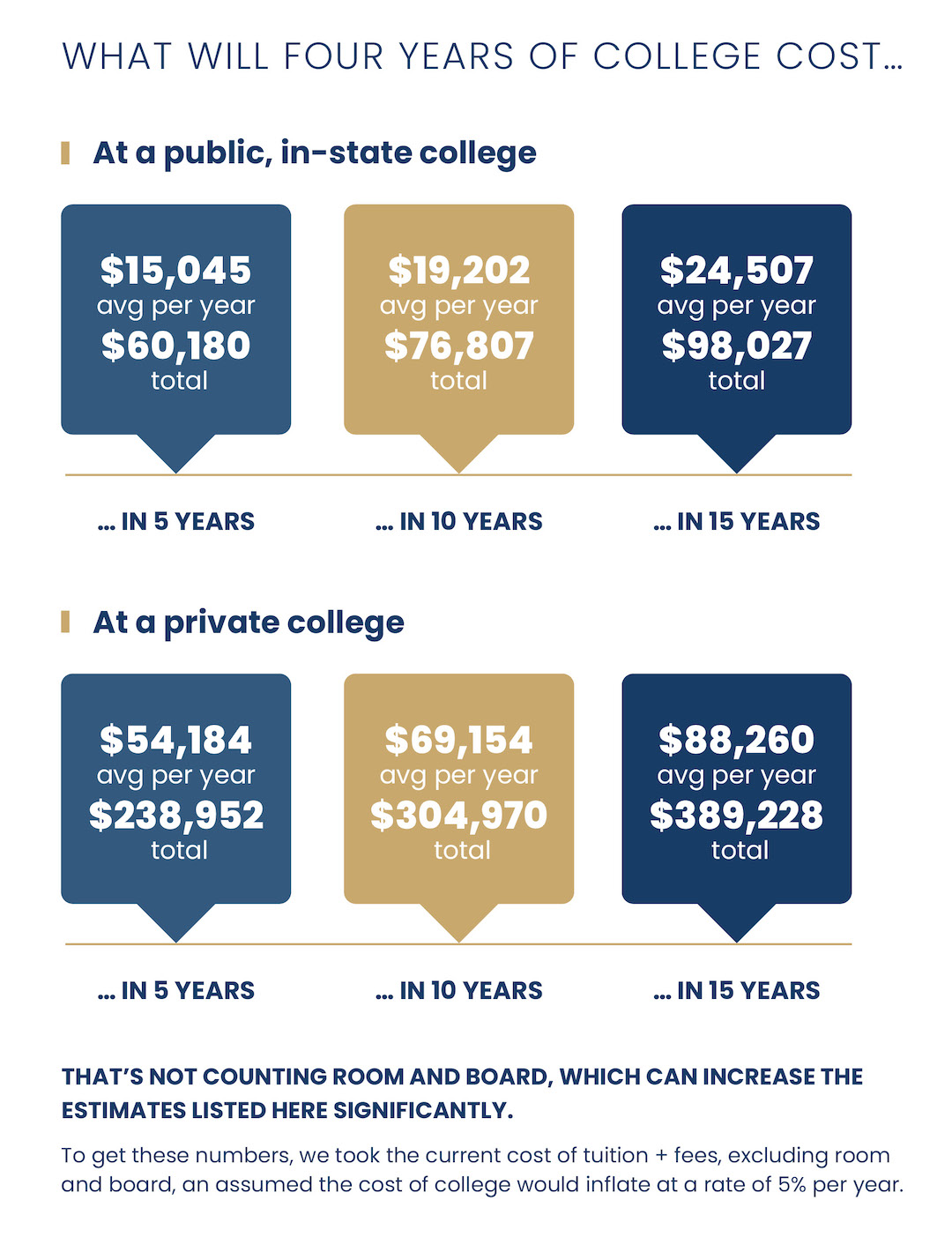

Assuming a 5% average rate of inflation, tuition at a state school will average nearly $14,000 in five years and increase every year your child is in school. That puts the total bill at more than $60,000 if your child is set to start college in five years. Keep in mind: That’s just tuition and doesn’t include added costs, like room and board. If your child is set to start college in 15 years, plan on $98,000 for four years at an in-state school.

If you want to send your child to private school, expect that first year to cost more than $50,000 for a total bill of roughly $239,000 over four years. If you’re a new parent, you’ll want to budget significantly more. Four years at a private university may cost upwards of $389,000 in 15 years.

Remember: These numbers are estimates. They’re intended to give you a sense of how much you’ll need to save. Plus, they help illustrate how 529s can be helpful. With costs rising at a rate of 5% a year on average, it’s clear why an investment account, with the potential for higher returns, makes more sense than a simple savings account.

How 529s work

529s are a tax-advantaged account. You contribute money after tax, but the money grows tax-free and withdrawals aren’t subject to federal income tax, so long as they’re used on qualified education expenses. (More on that later.)

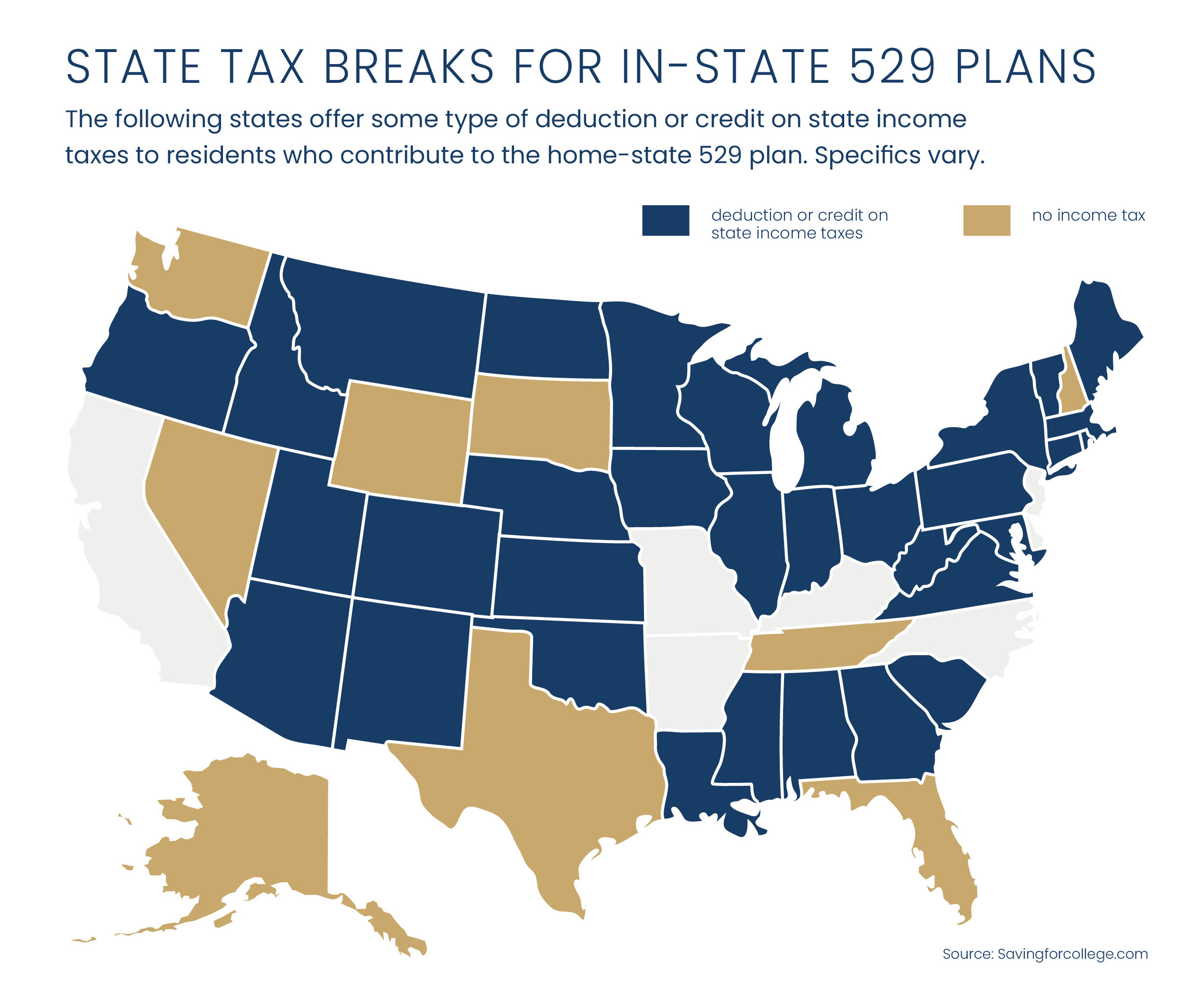

529s are run by states—all states have state-sponsored plans (with the exception of Wyoming, which uses Colorado’s plan). You’re not limited to the plan offered by your state, but some states do offer tax benefits to residents who use the state plan.

As with all investment accounts, which plan you select likely depends on its investments (selection, historical performance, etc.) and fees. Most states offer two versions of their 529 plan: One that’s available to retail investors and another that’s available to financial professionals—in other words, the kind of account Quorum Private Wealth would open on your behalf.

For instance, New York may offer a tax break for using the state plan while California does not. For Quorum clients in California, we might use the Virginia 529 plan, which is highly rated thanks to its low-cost offerings. It includes target date funds, which focus on growth early on, but shift toward more conservative investments during your child’s high school years. Clients in Virginia may qualify for a $4,000 annual tax deduction for using the state plan.

Contributing to a 529

There are two players in a 529 plan: the account owner and the account beneficiary.

The account owner refers to whoever opens the account, such as the parent or grandparent of a student. The account beneficiary is typically the student(s) who will use the funds to cover the cost of qualified education expenses.

In a traditional 529 plan, the account owner maintains control of the account. They can change the beneficiary at any time and withdraw funds (subject to a penalty if the funds aren’t used for qualified education expenses). You may also be able to open a custodial 529 plan where the beneficiary becomes the account owner when they reach legal age.

Account logistics—traditional versus custodial account owner—may affect the student’s eligibility for need-based aid, since they affect the assets you report on the Free Application for Federal Student Aid (FAFSA). This is especially true if you have more than one child. However, these details rarely matter for high income households that are unlikely to qualify for need-based aid.

Unlike IRAs, there are no annual contribution limits to 529 plans; however, there are a few rules to keep in mind. First, you can’t contribute more than the anticipated cost of college, though the details around this rule vary by plan. Second, large contributions made to a 529 account that you don’t own may be subject to gift tax. (For instance, if your child opened a 529 to benefit your grandchild, and you want to contribute more than the annual gift tax, you’ll need to file a form with the IRS.)

Using the funds in a 529

The government has expanded the ways you can use a 529 account several times in the past decade.

In 2017, the Tax Cut and Jobs Act updated the definition of “qualified education expenses” beyond college. Funds from 529 plans can now be used to pay for K-12 education as well, in amounts up to $10,000. Similarly, students may not need to attend a traditional college to qualify—vocational schools and continuing education programs generally qualify. Money in 529 plans can also be applied toward repaying student loans.

In 2022, Congress created even more flexibility via the SECURE Act 2.0. Starting in 2024, the plan beneficiary can roll up to $35,000 in unused funds from a 529 to a Roth IRA, subject to certain requirements. Primarily, you must be eligible to contribute to a Roth IRA (which has income ceiling limits), and the 529 account must have been open for at least 15 years prior to rollover.

These updated provisions may help ease concerns among parents who worry they’ll lose their savings if their child decides against a traditional four-year college education. Keep in mind: It’s also possible to transfer the beneficiary on a 529 account. You can update your 529 so unused funds go to another relative or even use them yourself to pursue continuing education.

One thing to consider: If you decide to use the funds in a 529 for non-qualified expenses, the withdrawals are subject to a 10% penalty. You’ll also need to pay tax on any investment gains.

Quorum Private Wealth can help you develop a college savings plan that’s tailored to your family’s circumstances and goals.