Every few years, three precious medals hold the world’s attention: gold, silver, and bronze. The metals used in those Olympic prizes, however, may be more important in terms of how they impact traders, investors, the global economy, and even how we think about money.

While stocks and bonds tend to be the core building blocks for most investors, at Quorum, we often discuss the importance of diversified portfolios. There are many ways to achieve that—for instance, alternative assets, like real estate or private market funds. Commodities are another common tool for diversification; gold specifically is viewed by many as an inflation hedge.

With that in mind, let’s dig into how commodities work and the different ways you can incorporate commodities into an investment portfolio—and why those investments may or may not make sense.

What are commodities?

Commodities are raw materials that can be bought, sold, and stored. In other words—they’re tangible goods. Gold, silver, copper, oil, and natural gas are among the so-called hard commodities. Agricultural products, including coffee, sugar, corn, and soybeans, are called soft commodities.

Buying and selling commodities

Commodities tend to be traded two ways: spot contracts and futures contracts.

Spot contracts reflect the current price of the commodity—you’re buying or selling it right now. Spot contracts resemble the type of market we’re used to—the price of a good tends to fluctuate based on both supply and demand. If a hurricane destroys Florida’s orange crop, supply shrinks. If demand is constant, orange prices will rise.

With futures contracts, you agree to buy or sell the commodity for a certain price in the future. This can help both buyers and sellers address large fluctuations in price.

For instance, frozen orange juice producers might agree to sell their product at a specified price in the future. If those prices surged because a hurricane decimated the orange crop that year, the seller would miss out on the price increase. (The buyer would save.) If the reverse happened—say demand for frozen orange juice fell dramatically—the futures contract helps protect the seller from the price drop.

Since futures contracts derive their value from an underlying asset, they’re known as a derivative investment and tend to carry more risk. Because of this, futures markets may not be as accessible, and therefore less well known, to retail investors.

The fact that derivatives, such as futures, carry more risk and aren’t suitable to every investor is one reason commodity investing is less popular than some other asset classes.

Physical delivery is another. While regular people (farmers, business owners) might use futures contracts to hedge and protect their businesses, traders tend to use them to speculate on market prices. However, these contracts come with physical delivery of the commodity. If a trader can’t accept 1,000 barrels of oil (the standard amount represented in a futures contract), that trader technically defaults on the contract.

Investing in commodities

With some commodities, though, physical ownership is the point. This is especially true with precious metals, like gold and silver. While currencies hold value because they’re issued and backed by a government—and because the world agrees they do—at the end of the day, dollar bills are simply fancy pieces of paper.

Gold and silver, on the other hand, have an inherent value on their own. (Gold’s value dates back thousands of years; traders used it as far back as 560 BCE.) This inherent value is what drives some people to buy precious metals during periods of inflation—when the value of paper money feels tenuous.

In these instances, investors tend to buy physical assets informally—in other words, they’re not necessarily using spot or futures contracts. Instead, they may be ordering gold bars to store in a safe.

For investors who don’t want to deal with derivatives or physical assets, there are exchange-traded funds (ETFs) or mutual funds that invest in or track the prices of commodities, including gold and silver.

Do commodities make sense for you?

Whether or not you should invest in commodities, like gold or even silver, depends on your personal goals and circumstances, as well as market conditions. Before you invest consider the following:

- Unpredictable events—like a hurricane destroying Florida’s orange crop or war disrupting global oil supply—can lead to big, unexpected price swings.

- Finite supply. With hard commodities, like metals and oil, the world’s resources are finite. At some point, we will have mined all the gold and oil in existence. For many investors, this is seen as a pro, since scarcity often creates value. But this isn’t a given. Consider how the value of oil might change if the world found a new source of cheap fuel.

- Inflation protection. When the price of goods and services increases, commodity prices tend to increase as well, as they are linked to production. (At times, increases in commodity prices are a driver of inflation.) Beyond that, many investors buy finite commodities, like gold or silver, as a hedge against inflation; increased demand also drives prices higher.

- (Lack of) Correlation. Commodity prices tend to move independent of stock and bond market prices. This makes commodities an excellent tool for diversifying a portfolio.

- Speculation. Traders and investors often watch commodity prices to try and predict future trends. For instance, copper is used so extensively—copper pipes in construction, copper wiring in electronics manufacturing, copper circuits in computer chips—traders began calling it “Dr. Copper.” These insiders thought that increased demand for copper (or rising copper prices) signaled an uptick in economic activity.

Commodities as part of a portfolio

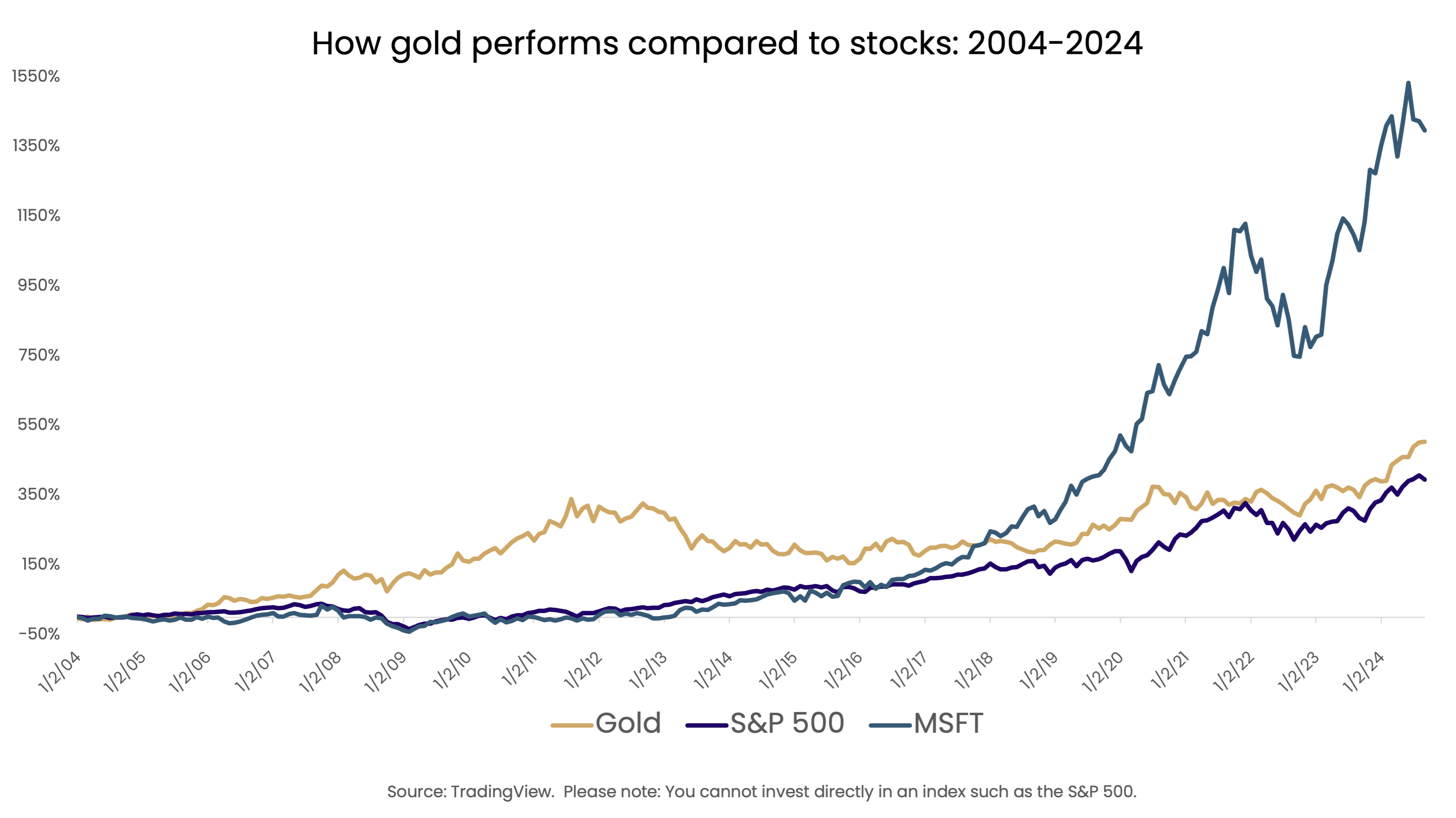

Let’s take a minute to consider how these various factors play out in the real world. If you had invested $1,000 into gold at the start of 2000, the investment would have increased in value to more than $6,000 this year—a return of more than 500%.

If you had taken that same $1,000 and put it in the S&P 500 (remember, you can’t invest directly in an index; this is for illustrative purposes only), you’d have nearly $5,000—a return of just under 400%. It’s worth noting that the S&P 500 experienced bear markets when the tech bubble burst, as well as the financial crisis during this period.

If we look at an individual stock however—Microsoft, for example—investing $1,000 in 2000 would have close to $150,000—a return of 1,396%. (Note: Microsoft underwent a share split in 2003 that is accounted for in this chart and these calculations.)

As you can see, gold can help diversify portfolios and may outperform stocks during periods of market turmoil. But whether commodities make sense for you depends on where else you’re invested, as well as your personal goals and outlook.

If we decide commodities might be a good fit, the next step would be to figure out the best way to incorporate that exposure. Those options are best discussed in person so we can tailor the discussion to your circumstances. If you have questions about how commodities might fit into your portfolio, set up a time to discuss.